Managing finances while running a business can be a daunting task, often leading to feelings of overwhelm. Keeping track of payments, expenses, and transactions can quickly become a daunting task. However, with the advent of modern technology, there are numerous tools and software available to streamline financial processes. One such tool that has revolutionized accounting for businesses is QuickBooks. In this post, we will explore how QuickBooks checks can simplify your business finances and save you time and effort.

Understanding QuickBooks: A Brief Overview

QuickBooks is an accounting software developed by Intuit that has gained immense popularity among small and medium-sized businesses. The software offers a user-friendly interface that allows businesses to manage their financial transactions efficiently. With QuickBooks, you can create and print checks directly from the system, eliminating the need for manual check-writing.

The Benefits of QuickBooks Checks

- Streamlining Financial Transactions

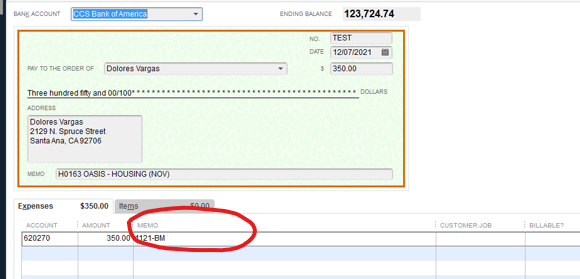

QuickBooks checks automate the process of writing and recording payments, making it a breeze to manage finances. You can input vendor information and payment details and customize check layouts, ensuring a professional and consistent appearance for all your checks.

- Enhanced Security

Security is a top priority for businesses, and QuickBooks offers multiple security measures to safeguard your financial data. With encrypted transactions, password-protected access, and secure servers, you can trust QuickBooks to keep your information safe.

- Automated Record-Keeping

Gone are the days of manually entering every transaction into a ledger. QB checks automatically record all payments and expenses, allowing you to generate detailed reports with just a few clicks.

How to Get Started with QuickBooks Checks?

- Selecting the Right Version of QuickBooks

Before diving into QuickBooks checks, you must choose the right version that suits your business needs. Whether it’s QuickBooks Online, QuickBooks Desktop, or QuickBooks Self-Employed, each version offers specific features tailored to different business types.

- Setting Up Your Business Profile

Once you have selected the appropriate version, it’s time to set up your business profile. Input your company’s information and tax details, and add your logo to personalize your checks further.

- Adding Bank Accounts and Vendors

To fully utilize QB checks, link your bank accounts and add vendor information. This step will streamline the payment process and help you keep track of transactions with ease.

Printing QuickBooks Checks

- Customizing Check Layouts

QuickBooks allows you to customize check layouts to match your brand’s aesthetics. Add your company’s logo, choose fonts and colors, and create a professional check template.

- Linking Bank Accounts

Linking your bank accounts to QuickBooks ensures that transactions are recorded accurately and reduces the chances of errors.

- Printing Checks in Bulk

Save time and effort by printing multiple checks at once. QuickBooks enables you to print checks in bulk, making payroll and bill payments a breeze.

Tracking Finances and Payments

- Categorizing Transactions

QuickBooks allows you to categorize transactions, making it easier to generate detailed financial reports. This feature provides valuable insights into your business’s financial health.

- Generating Reports

With just a few clicks, you can generate comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow reports.

- Managing Invoices and Payments

Use QuickBooks to manage invoices, track payments, and send reminders to clients. This feature ensures a smooth invoicing process and improves cash flow management.

Mobile Access and Convenience

- QuickBooks Mobile App

With the QuickBooks mobile app, you can access your financial data on the go. Stay connected to your business and manage finances from anywhere.

- Managing Finances on the Go

Whether you are attending meetings, traveling, or working remotely, the mobile app allows you to handle financial tasks efficiently, ensuring you never miss an important transaction.

QuickBooks Integrations

- Syncing with Other Business Tools

QuickBooks integrates seamlessly with various business tools, such as CRM software, project management systems, and e-commerce platforms, further streamlining your business operations.

- Connecting with Online Payment Platforms

Integrate QuickBooks with online payment platforms to facilitate easy and secure payment processing for your clients and customers.

Common Troubleshooting Issues and Resolutions?

- Bank Reconciliation Discrepancies

If you encounter bank reconciliation discrepancies, QuickBooks provides step-by-step guidance to help you identify and resolve the issues.

- Printing Errors

In the event of printing errors, ensure that your printer settings are configured correctly and that you have the latest printer drivers installed.

- Syncing Problems

If you experience syncing problems, check your internet connection and ensure you are using the latest version of QuickBooks.

QuickBooks Security Measures

- Protecting Sensitive Data

QuickBooks employs encryption and secure data storage to protect sensitive financial information from unauthorized access.

- Implementing Two-Factor Authentication

To enhance security, enable two-factor authentication, adding an extra layer of protection to your account.

- Regularly Updating the Software

Stay protected from potential security threats by regularly updating your QuickBooks software to the latest version.

Tips to Maximize Efficiency with QuickBooks Checks

- Regular Backups

Perform regular backups of your QuickBooks data to ensure that you never lose important financial information.

- Regular Software Updates

Keep your QuickBooks software up-to-date to access new features, improvements, and bug fixes.

- Utilizing Keyboard Shortcuts

Save time navigating through QuickBooks by using keyboard shortcuts for common tasks and commands.

The Future of QuickBooks: What to Expect

As technology advances, so does QuickBooks. Expect more user-friendly interfaces, AI-driven features, and enhanced integrations with other business tools.

FAQs

- Is QuickBooks suitable for large enterprises?

QuickBooks offers versions designed for businesses of all sizes, including large enterprises.

- Can I use QuickBooks on multiple devices?

Yes, you can access QuickBooks on multiple devices using the same account.

- Does QuickBooks support international currencies?

Yes, QuickBooks supports various international currencies for global businesses.

- Can I customize the reports generated by QuickBooks?

Absolutely! QuickBooks allows you to customize reports to meet your specific needs.

- Is QuickBooks compatible with Mac computers?

Yes, QuickBooks has versions compatible with both Windows and Mac computers.

Conclusion

QuickBooks checks provide an efficient and secure way to manage your business finances. With features like streamlined financial transactions, automated record-keeping, and enhanced security, QuickBooks simplifies accounting tasks and allows you to focus on growing your business.